Are you looking to invest your money in the stock market and make a steady income? Dividend stocks are an ideal choice for investors looking for a consistent source of income. Dividend stocks provide a great opportunity to earn money from your investments, and there are many different stocks that offer attractive dividends. In this article, we’ll share the best dividend stocks available in the market today and explain why they are a smart choice for investors. Read on to learn more about the top dividend stocks and find out how to start investing in these stocks for a regular income.

Johnson & Johnson (JNJ)

If you’re looking for a great dividend stock, Johnson & Johnson (JNJ) is a great choice. JNJ has been a leader in the healthcare industry for years and has established itself as a reliable and consistent dividend stock. With a current dividend yield of 2.79%, JNJ is one of the highest yielding dividend stocks available. Not only that, but the stock has a long history of increasing its dividend payments over time. This makes it a great choice for investors looking for both current income, and long-term returns. JNJ also offers a diversified portfolio, with exposure to a variety of industries, giving investors greater peace of mind. All in all, JNJ is a great pick for investors looking for a reliable and consistent dividend stock.

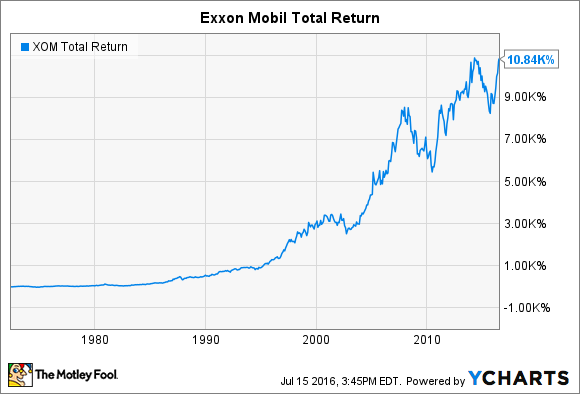

Exxon Mobil Corporation (XOM)

Exxon Mobil Corporation (XOM) is one of the top dividend stocks to invest in if you’re looking for long-term growth and reliability. XOM is one of the largest oil and gas companies in the world, and their long-term performance speaks for itself: for the last 35 years, XOM has consistently increased their dividend payments to shareholders. The company is also financially strong and has a strong balance sheet, meaning there’s a good chance you’ll get a steady stream of dividend payments from them for years to come. And if you’re looking for growth potential, XOM has a solid track record of increasing the size of their dividend payments over the years. All in all, XOM is a great stock to consider if you’re looking for a reliable dividend payer.

Procter & Gamble Co

Procter & Gamble Co is a great stock for dividend-minded investors. This company has been around for more than 180 years and is one of the world’s largest consumer goods companies. It is a Dividend King, meaning it has increased its dividend for at least 50 consecutive years. This stock offers a dividend yield of more than 3%, which is higher than the 10-year US Treasury bond yield. P&G also has a strong record of delivering consistent dividend growth over the years. Its dividend has grown at a compound annual growth rate of more than 6% since 2005. P&G has a strong balance sheet, with a debt-to-equity ratio of 0.7. This makes it a safe bet for investors looking for a steady income stream.

(PG)

PG is one of the most reliable dividend stocks out there. Not only are they consistently increasing their dividend payments, but their stock price has also been steadily increasing. PG has a long history of steady growth, making it a great choice for those looking for steady returns. They also have a strong balance sheet, with a healthy cash flow, which helps to ensure that they can continue to pay their dividends in the long term. The returns are also attractive, with a dividend yield of around 3%, which is significantly higher than the average dividend yield of the S&P 500. On top of that, PG’s stock price has been outperforming the market for the last five years, making it a great choice for long-term investors.

Chevron Corporation (CVX)

Chevron Corporation (CVX) is an American multinational energy corporation that deals in refining, marketing, and transportation of oil products. It is one of the most reliable dividend stocks to invest in as it has an impressive dividend yield of 5.3% and a long history of increasing dividends every year since 2012. The company has also consistently grown its earnings and cash flow over the years, and its strong balance sheet allows it to continue to pay dividends without any worries. Chevron also boasts a low payout ratio of 34.7%, which means there is potential for future dividend increases. If you’re looking for a reliable dividend stock to invest in, Chevron Corporation should definitely be at the top of your list.

Microsoft Corporation (MSFT)

Microsoft Corporation (MSFT) is an amazing stock for dividends! When you invest in MSFT, you’re investing in a company that is a leader in the tech world and is always innovating. Not only do you get the benefit of a reliable dividend, you also get to be part of a company that is constantly pushing the boundaries of what technology can do. MSFT is a great choice for investors looking to add a tech giant to their portfolio. It’s a great way to diversify your investments while still having the assurance of a steady dividend payout.